One of the biggest challenges for marketers working in the asset management industry is how to take raw data and distribute it in an accurate and attractive way. Not only should data be presented in a clear, simple and precise style, but the story the data tells should also be accessible for a range of audiences if you really want to grow your assets under management (AUM).

In this post we run through five top tips for those looking to harness the power of raw data.

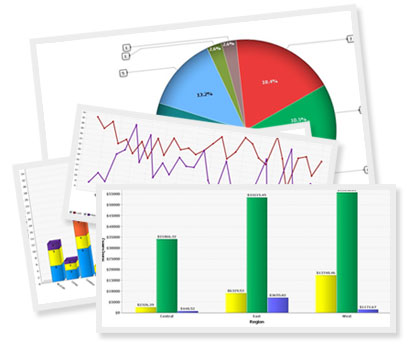

Visualisation

When it comes to communicating data, pictures speak louder than words. Recent surveys have shown that 80% of investors class price and performance tables as essential when it comes to analysing and understanding fund market data.

However, in order to use data visuals most effectively, it is important to be selective in their use. While it is tempting to use charts to visualise all your data, having too many can lessen their impact.

Similarly, it is important to keep visualisations as simple as possible. We are big believers in the ‘less is more’ philosophy. All too often visualisations contradict exactly what they are meant to achieve - which is to bring clarity and simplicity to your marketing material. Obviously busy infographics have their place, but there is a lot to be said for using a clear and simple line chart to communicate fund performance.

Branding

In today’s competitive climate, it is crucial to get the most out of every customer communication. By branding your data sets and visuals you will not only re-enforce your brand, but you will make your data recognisable - and people like what they recognise.

Typically, well branded data documents tend to have logos in the top corner, they stick to the firm’s colour pallet and they have a uniform typography. This helps to make them recognisable to advisers and, in the most successful cases, to clients.

It’s important to remember to be consistent with branding, so make sure your data is in line with your brand guidelines so they match your website and other marketing channels. You can also promote consistency by incorporating your firm’s logo and colour pallet when designing the charts and tables included in your factsheets.

Layout

The way you layout your data is very important, especially when you take into account how little time advisers have to read the plethora of fund documents they receive. While it sounds obvious, there are certain ways of laying out your data that can instantly make it more appealing.

For example, introducing the fund manager with a picture and a short bio at the top of your factsheet adds a human element to your data.

Then, you should start with the most important information such as the fund’s objective, pricing and performance. This quickly gives the reader the key initial information they often need.

Secondly, empty space is hugely underrated.

We have discussed how less is more in data visualisation, but the same is true for how you layout your factsheets. You will be surprised at how effective white backgrounds and leaving space between charts can be to the overall appearance of your data.

Make it interactive

In our modern times, asset managers are increasingly making their data interactive. We have talked about how difficult it can be to get clients to engage with data, but interactive charts and tables go a long way to bring your data to life.

Many firms are already embracing these on their websites and online factsheets.

Making your data interactive also improves efficiency as it allows for self service.

Clients can manipulate a standard chart to get the information they want, or even find multiple sets of information from the same chart.

Accuracy

Remember that you can have the most beautiful, interactive and recognisable factsheet but, ultimately, this is all redundant if your data fails when it comes to accuracy.

Data accuracy is essential in retaining trust so it is in every firm’s best interest to have an effective data management system.

For asset managers without the in-house capabilities to sort through their own data, there are an increasing number of products on the market that make outsourcing all aspects of data management simple and effective.

Some of the best products are offered by FundConnect, Kneip and FE. The latter has recently launched FE Precision+, a one stop solution, if you will, that includes collecting your raw data, cleaning it and checking for accuracy before distributing it as and when you request in a format that you want.

The service ultimately removes the headaches of data management but without the loss of control that asset managers are wary of.

Read