FE has been ranked number 43 in the annual Sunday Times BDO Profit Track 100, which was published in the Business section of The Sunday Times on 7 April 2019.

Claire Lewis

Recent Posts

FE ranked at number 43 in The Sunday Times BDO Profit Track 100

Mon 8 Apr, 2019 / by Claire Lewis

Over 30 DFMs Sign Up to the Model Portfolio Transparency Revolution

Wed 7 Feb, 2018 / by Claire Lewis posted in FE Transmission

A total of 31 discretionary fund managers (DFMs) have signed up to FE Transmission, the service which allows financial advisers to research and analyse model portfolios and DFMs.

Jupiter European takes top spot in adviser research rankings for 2017

Tue 19 Dec, 2017 / by Claire Lewis

- Standard Life’s GARS drops out of top three for first time

As 2017 draws to a close, FE takes a look at the funds that have piqued adviser interest and those which have fallen out of favour on FE Analytics, the leading investment research and analysis tool.

Will PRIIPs and MiFID II be the Grinches that steal this year’s Christmas?

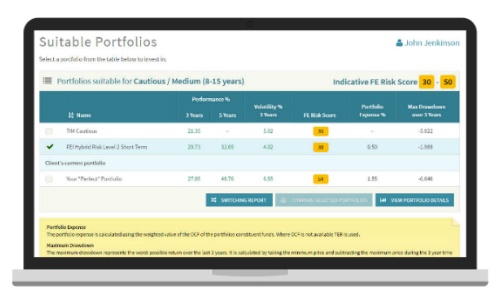

- FE’s whole of market data uniquely allows advisers to map any investment solution to a clients’ risk profile

FE, a leading investment ratings and research agency, today announced the launch of FE Analytics+ Investment Planner, a step by step investment process to help advisers meet suitability requirements and deliver consistent investment advice.

Board of Directors Appoints Neil Bradford as CEO of FE

Tue 12 Sep, 2017 / by Claire Lewis

FE, a leading investment ratings and research agency, today announced that the Board of Directors has appointed Neil Bradford as CEO, a newly created role to help position the firm for its next phase of growth. He joined FE on the 11th September 2017.

Uncertain Macro Outlook Drives Latest Changes to FE Approved Funds List

Mon 11 Sep, 2017 / by Claire Lewis posted in FE News

Funds that could help investors protect capital from unpredictable markets and increase portfolio diversification are the focus of the latest FE Invest Approved List rebalance.

FE backs defensive funds in bi-annual rebalance of Approved Funds List

Mon 13 Mar, 2017 / by Claire Lewis

- Gilts exposure remains essential portfolio insurance against equity market sell-off

- Absolute Return exposure complemented with additional defensive options

- Reduced international exposure, increased UK equity exposure

Funds that could help investors protect capital from unpredictable markets and increase portfolio diversification are the focus of the latest bi-annual FE Invest Approved List rebalance.