Although the economies of Brazil, Russia, India, China and South Africa have been heralded as a good move for investors looking to gain from rapid economic development – the BRICS economies have come under fire recently after high levels of volatility and a failure to deliver on the good returns predicted of them.

But while this may well be the case for many of the BRICS economies, there has been one exception.

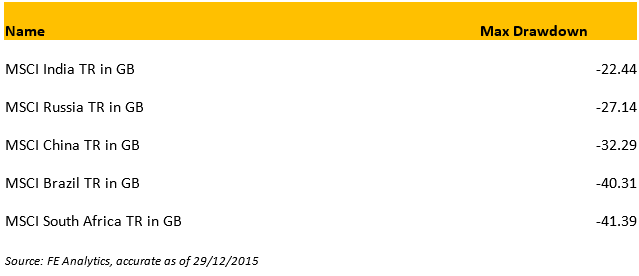

India has been less volatile compared to the other BRICS countries over the past year, as we can see by looking at the max drawdown figures – which indicate peak to trough decline in performance.

The MSCI India has a year-to-date max drawdown of -22.44 per cent according to FE Analytics data. This means that if you had invested in the fund at its peak this year and sold at the fund’s lowest point you would have lost 22.44 per cent. To put this in perspective the BRICS market with the largest max drawdown figure was South Africa at - 41.39 percent.

Over the past year India’s market that has not mirrored the trends of many of the other emerging market economies and is widely regarded to emerge as one of the fastest growing economies in the world over the next few years.

Thomas McMahon, fund analyst at FE Research, says: “India was hotly tipped to do well this year following the election of a new Prime Minister, Narendra Modi, on a platform of economic reforms. It has also been a major beneficiary of a falling oil price as the country imports a high proportion of its energy.”

McMahon adds: “The MSCI India is down just 3 percent year-to-date in rupees and 3.5 per cent in pounds although the index is still beating the IA Global Emerging Markets sector, which is down 10.73 per cent.”

McMahon says: “There has been a high disparity of returns on stocks in the country, with companies exposed to mining such as Vedanta and Tata down 50% or more. Others have done very well, such as selected financials and auto stocks.”

Therefore, investors who took an active approach to investing in India could have done well this year with data from FE Analytics showing that the best India fund year-to-date returned 11.01 per cent. The JGF-Jupiter India Select fund has been awarded two FE Crowns and has an FE Risk Score of 134.

See below for the best performing India funds year-to-date, from the IA’s Specialist sector, according to FE Analytics data.

Source: FE Analytics

For exposure to India within the confines of the Global Emerging Markets sector FE Research like Fidelity’s Emerging Market fund, run by FE Alpha Manager Nick Price.

McMahon adds: “The fund is down only 1.72% in 2015 rather than the 10.5% loss for the MSCI Emerging Markets index. This has been helped by strong stock-picking in both Russia and India: Price had HDFC Bank, up 14%, and Maruti Suzuki, up 40% in India and exposure to Russian companies which are seeing their profits grow thanks to a falling rouble – those with costs in roubles but revenues in stronger currencies. Since launch it is up 25.7% compared to a 0.1% return for the MSCI Emerging Markets over the same period.”