In line with the first anniversary of FE Passive Crown ratings, the ratings and research firm has launched the industry’s first pure passive fund awards. This is in recognition of the growing importance that passive investing plays in the UK asset management industry and the commitment and professionalism of passive investing teams (Please see below for full list of 2016 winners).

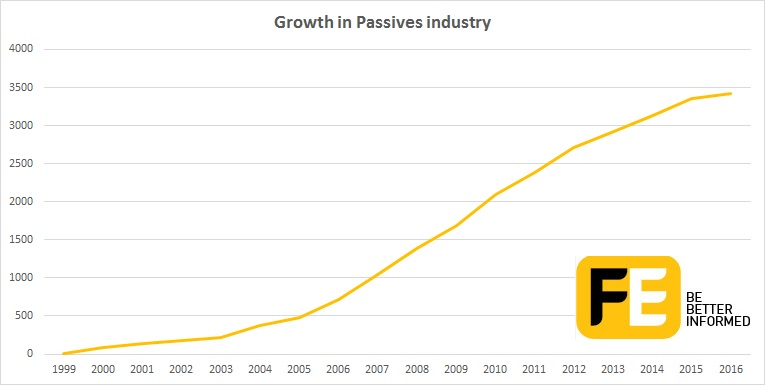

The passives industry has boomed in recent years, with the number of global ETFs rising from 713 in 2006 to 3,423 as of May this year, according to FE Analytics data.

Further, figures published this month show that assets invested in ETFs/ETPs listed globally reached a new record high US$3.143 trillion at the end of May 2016. Focussing in on the UK, the latest figures from the Investment Association show that tracker funds have £109.2 billion funds under management at the end of April 2016 – making that 10.7 per cent of industry funds, up 1.1 per cent from last April.

Mika-John Southworth, director at FE says: “In the course of collecting data on over 3,000 passive funds we recognise the valuable role passives play in helping investors construct cost effective portfolios. Although the rise in the number of passive funds is impressive, there is a stark difference in performance between the best and worst passive funds. We appreciate of the lengths that some asset managers go to provide the most effective and lowest cost investment options, therefore we felt that it was right to recognise these participants with their own awards.”

The winning passive funds were awarded the top spots according to a purely quantitative methodology looking at tracking difference, tracking error and fund size over the past three years.Matthieu Guignard, global head of product development and capital markets, Amundi ETF, Indexing & Smart Beta, said: “We’re delighted to have been nominated by FE - especially as they seek to select funds for their quality of replication. Maintaining low levels of tracking error and tracking difference is core to providing clients with efficient and reliable investment tool.”

To score top marks across the three criteria, passive funds have to have a tracking difference of less than 0.75 per cent, a tracking error equal to or less than 0.5 per cent and a fund size of over £100m.

The Passive Award winners are determined by picking the overall top scorer from each sector across the three components. Where there were any funds which were equally scored overall, these were first ranked on their tracking difference score (as this is the largest component of the overall score) and finally tracking error.

Oliver Clarke-Williams, head of ratings at FE Research, runs through the salient points to look out for when assessing a passive fund.

Clarke-William says: “Tracking error is a good indicator of how well a fund is tracking its respective index, but should not be the only thing assessed when considering a passive and its performance. It’s important to take tracking difference, cost and fund size into consideration.

“Tracking difference is important in that it shows how different the performance has been over time relative to the respective index it is tracking. It can be used together with fund size to give an indication regarding how expensive/efficient the fund is.

“Although it is not typically discussed when comparing tracker funds, we take fund size into consideration because it is generally desirable for a fund to have a certain level of scale to be an economic proposition. Funds are therefore rewarded for being larger.

“It is also important to look at cost, a low tracking error is desirable but only if the cost of that passive does not significantly up how much you ultimately pay out in costs.”