Man GLG – Continental European Growth, Scottish Widows European Focus and Threadneedle European Select are the top consistently performing European funds over the past 5 years – despite the on-going market volatility in the Continent - according to new research from FE.

Europe has been voted as the region professional investors best like to outperform in 2016, according to a survey of advisers by FE Trustnet carried out late last year. Nearly 30 per cent of the 2,524 advisers surveyed were optimistic that European equities are likely to surpass other markets over the coming 12 months.

Further, a recent Bank of America Merrill Lynch report also showed that asset managers viewed Europe favourably - with 50 per cent of fund managers surveyed for the report saying they expect stronger growth in the region with a 12 month view.

The latest figures published by the Investment Association also show that European equity funds were the best-selling sector in 2015 with record net retail sales of £4.5 billion, up from £221 million in 2014 – suggesting a consistent level of confidence in Europe’s prospects.

So, for investors who are bullish on Europe, but also concerned over the recent, and seemingly on-going, market turbulence – ratings and research firm FE has found the top ten most consistent performing European funds and out of these, the funds that have ranked well in terms of volatility.

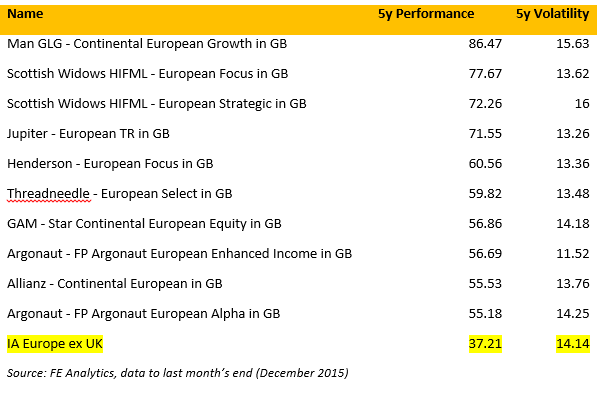

Looking at a five year time period to the end of December, the below table shows the top ten performing funds in the IA’s European ex. UK sector – where the average fund returned 37.21 per cent - according to FE Analytics data.

The Man GLG – Continental European Growth fund has been the best performing over the period. The fund returned some 86.47 per cent as of the end of December, according to FE Analytics data – with its benchmark, the FTSE Europe ex UK returning just 28.74 per cent over the same period.

The Scottish Widows HIFML – European focus and European Strategic funds came second and third, respectively returning 77.67 per cent and 72.26 per cent– with the European Strategic fund being the most volatile out of the top three with a volatility ratio of 16. The average volatility ratio for the sector is 14.14.

For investors looking to avoid riskier funds, the fund with the lowest volatility ratio, 11.52, in the sector is the Argonaut European Enhanced Income fund which is amongst the top ten performers, returning 56.82 per cent according to FE Analytics data. The fund has been awarded five FE Crowns.