Shares in British fashion stalwart, Burberry have fallen nearly 12 per cent following the company’s warning that sales had been hit by the slowdown in China.

The luxury fashion group said retail sales have been impacted by a slowdown in the demand for luxury goods – especially from the Chinese market.

Research manager Charles Younes from FE Research says: “Burberry’s latest update underlines just how integral China is to many big name luxury companies reliant on appetite from the Asian nation. This is not the first company to point to a Chinese slowdown as cause for poor sales performance – LVMH and Gucci’s owner Kering recently did the same, and it certainly will not be the last.”

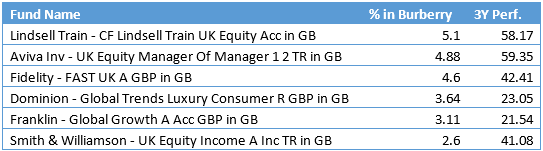

Data from FE Analytics shows six funds with the highest exposure to Burberry. These funds hold the luxury fashion house in their top 10 holdings – ranging from 2 per cent to just more than 5 per cent.

Lindsell Train’s highly rated UK Equity fund has the highest exposure to Burberry in the Investment Association universe, according to FE Analytics data. The fund is awarded 5 FE Crowns as well as awarded Gold by Morningstar.

Aviva’s UK Equity Manager of Manager has a 4.88 per cent exposure while Fidelity’s Fast UK has 4.6 per cent. See below for the 6 funds.

Younes adds: “While Burberry may impact the Lindsell train fund’s performance in the short term, manager Nick train has a very long term view on stock picks – and aims to pick companies which have a good chance of lasting the next 20 years.

“So he is not trying to beat quarterly estimates from financial analysts – also worth noting that the fund’s largest holding Unilever surprised the market with an upgrade on its annual sales forecast.”

6 funds with the highest exposure to Burberry

Source: FE Analytics.