Franklin Mid Cap, Marlborough UK Multi-Cap Growth and AXA Framlington UK Select Opportunities top the list of funds consistently rewarding long term investors, according to recent research from FE Trustnet.

A fund that can outperform its peers year-in year-out is the Holy Grail for long-term investors. But with the multitude of factors that can, and do, take their toll on market conditions, finding a consistent performing fund in an ever-changing market is difficult, to say the least.

While critics of active management have often pointed out that funds which outperform in some years go on to lag in others, FE Trustnet research has uncovered the funds which have managed to return consistently over a longer timeframe.

The study looked at the IA UK All Companies sector for funds with a strong record in beating their average peer over five years, regardless of when you look at the fund.

To do this, FE Trustnet examined the funds’ five-year quartile rankings over rolling quarterly periods (the time periods in which the average long-term investor reviews their holdings) going back to the start of 2000 to see which have resided in the first or second quartile the most.

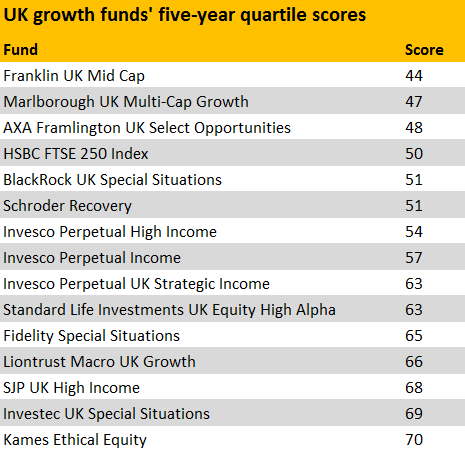

There were a total of 44 periods involved in this, so if quartile rankings are turned into a simple score those that have consistently been in the top quartile scored 44 while that sitting in the bottom quartile will have a score of 176 against their name.

The table below shows the 15 highest scoring funds out of the 121 with a track record since 2000.

The results put the Franklin UK Midcap fund at the top of the leader board, headed up by FE Alpha Manager Paul Spencer. The has made a 516.81 per cent total return since its launch in July 1999. Its FTSE 250 benchmark has risen 379.62 per cent while its average peer is up just 101.21 per cent, according to FE Analytics.

The FE Trustnet study found the Marlborough UK Multi-Cap Growth, which has been headed by FE Alpha Manager Richard Hallett since August 2005, in second place.

The fund has been in the first quartile for 41 of the 44 periods and in the second quartile for three (all of which occurred before Hallett took over the portfolio).

Long-term investors in Nigel Thomas’ AXA Framlington UK Select Opportunities fund were also rewarded, returning 315.19 per cent since the manager took over in September 2009. Its average peer has made 178.74 per cent over this time.

The FE Trustnet study also found that recovery or special situations funds have had good five-year returns since the start of 2000 - reflecting the tendency for value style investing to outperform over the long term – despite this investment style struggling recently due to the strengthening economy.

Source: FE Analytics, data to October-end.