Advisers can now assess the risk levels of any given portfolio, be it an adviser-constructed portfolio or a model portfolio, using FE Portfolio Risk Scores available through FE Analytics.

Key points:- FE launches FE Portfolio Risk Scores – which assess the risk levels of any given portfolio;

- Portfolios which contain multiple risk scores often give a lower score overall, ie, they should not always be viewed in isolation;

- The Risk Score, which defines risk as a measure of volatility relative to the FTSE 100, is recalculated weekly for funds with a minimum 18-month track history;

- Enables advisers to effectively compare models like-for-like and make informed suitability recommendations, as well as help with optimising risk budgets;

- Drives transparency and openness into the market.

Advisers can now assess the risk levels of any given portfolio, be it an adviser-constructed portfolio or a model portfolio, using FE Portfolio Risk Scores available through FE Analytics.

FE Portfolio Risk Scores enable the advisory industry to accurately gauge the true relative risk of any given portfolio to help assess suitability. FE Portfolio Risk Scores highlight that multiple fund risk scores often give a lower overall score in a portfolio and advisers should not assess individual fund risk scores in isolation. (See example below.)

The FE Risk Score (which can be viewed as part of a Portfolio Risk Score), define risk as a measure of volatility relative to the FTSE 100 index, which has a risk rating of 100, and is rebased to sterling. Instruments more volatile than the FTSE 100 have a score above 100 and vice versa – giving a more reliable indication of relative risk and which is likely to provide a clearer indicator of important risk changes.

Gary Wheeler, director at FE, says: “Given the importance of due diligence and assessing suitability during the investment advice process, being able to use FE Risk Scores throughout for all instruments, and now for overall portfolios, is fundamental in helping the advisory community compare like-for-like and drives greater transparency.

“The launch of FE Portfolio Risk Scores was the natural step to offering a comprehensive risk scoring service for advisers, and is necessary in order to bring further transparency to the investment landscape.

“The majority of advisers who use the Risk Scores have also been using it to communicate difficult investment concepts to their clients – and this needed to be available for all types of portfolio in order for an adviser to do this easily. What the FE Portfolio Risk Scores highlight to advisers and their clients is that multiple risk scores often giving a lower score overall – and therefore really shouldn’t be assessed in isolation.”

FE Risk Scores are recalculated weekly on a rolling three-year total returns basis. Most funds tend to fall between one and 150, with direct equities scoring tending to score above 100 and pure cash at zero. In order to qualify for a Risk Score, funds need an 18-month track record.

There is also a decay factor built into FE Risk Scores - so that older values carry less weight. This means that the scores are more responsive to recent events, without being excessively sensitive – a fundamental feature, considering the current market volatility.

Advisers can import their clients’ current portfolios and use FE Risk Scores as one of the measures they can look at to genuinely assess the benefits of switching portfolios.

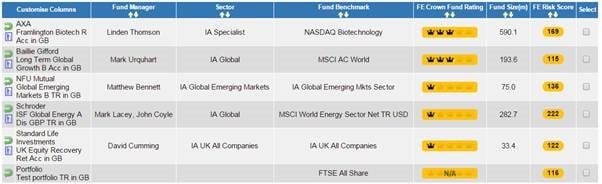

Below is an example of how advisers can use the FE Risk Scores to calculate the relative risk of any given portfolio.

We have put together five of the riskiest funds in the current market open to retail investors and have highlighted the FE Risk Scores attached to the funds individually.

Note that when combined within a portfolio in equal weighting, the risk score of the entire portfolio is much lower.

Thomas McMahon, analyst at FE Research, says: “If you look at the table, you’ll see that individually risky investments can, when put together, form a much less risky portfolio if the risks they take are uncorrelated, ie, if they tend not to move up or down at the same time.

“For example, biotechnology and energy stocks are driven by different factors, so when one is falling fast the other might be rising or remain flat, or fall by much less. This means the overall change in the portfolio value is smaller than if it was fully invested in energy or biotech.”

The need for FE Risk Scores across all instruments is being welcomed across the industry.

Lawrence Cook, head of business development at Thesis Asset Management, says: “There is a need for advisers to make sure that model portfolios have the same levels of comparability and transparency as funds.

“The FE launch of FE Portfolio Risk Scores is a great step forward as it helps advisers to compare models like-for-like and make informed suitability recommendations, as well as being able to optimise risk budgets. Because the Risk Score is relative to the FTSE, it is also a very simple way of communicating a complex concept to clients. We are pleased to have the Thesis models risk rated in this way to help improve transparency and openness for IFAs.”

FE Portfolio Risk Scores adds to FE’s chest of solutions to help advisers decipher the still relatively opaque world of investment funds and model portfolios.