It’s Christmas and whilst everybody is feeling festive – we thought we’d use the 12 Days of Christmas as inspiration and look at 12 ways FE has helped its ‘true loves’ i.e. Advisers this year!

1. Unique Model Portfolio Research

The FE DFM Survey found that whilst nearly 70% of our Adviser clients had invested client money in a Discretionary or Model Portfolio Service, more than 40% of them admitted to finding it ‘Extremely difficult’ or ‘Very difficult’ to access quality research and analysis on the value of options available to them. We soon found that the results of the survey echoed an industry wide concern about the lack of transparency around performance, charging and risk mandates for model portfolios. This lack of research available to Advisers also meant that they were unable to conduct objective analysis on the suitability of the solutions they were choosing, particularly on an ongoing basis.

So this year we decided to support clients by providing them with a solution that would look to address this lack of transparency - FE Transmission.

FE Transmission allows advisers to access model portfolio data at a holdings level to conduct objective due-diligence, bespoke comparisons and produce comprehensive client reporting – allowing for more structured research on their outsourced investment propositions. Over the last 9 months since launch the service has helped hundreds of Advisers to enjoy investment success by adopting a compliant method of MPS/DFM selection.

2. A Dedicated Risk Targeted Multi Asset Universe

Multi – Asset funds have seen significant interest from Advisers and Investors alike due to their ‘ready-made’ portfolio like structure, leading to many new solutions being made available in the market place.

FE’s Risk Targeted Multi Asset Universe enables Advisers to compare the burgeoning ranks of these types of funds and to assess their returns in relation to the risk taken. The universe is divided into five risk bands with funds assigned a band according to their FE Risk Scores. These scores measure the historic volatility of an investment instrument against the FTSE 100. The FTSE 100 maintains an FE Risk Score of 100; funds that are less volatile have a lower score and vice versa, with cash scoring zero. While a fund’s position within a band is not static, to avoid excessive churn between bands, funds must fall outside the risk parameters of their current band for more than 16 weeks before being reassigned.

3. Optimising Fund Selection

For the traditionalists who enjoy fund picking – FE Analytics has over the last decade provided over 3,000 Advisers access to nearly 300,000 financial instruments – 99% of which are refreshed daily by ISO credited global data teams. The wealth of dynamic tools on FE Analytics supports Advisers in creating an optimal fund panel. To note in particular is the powerful fund filter tool, where Advisers can pick and list selection criteria to be run across the market data (UT & OEICS, IT, ETFs, Offshore funds etc) to create an optimal fund shortlist. The shortlist can then be further investigated reviewing its provider factsheets, asset allocations, manager information, yield, platform availability, asset class availability charges and more.

4. Our own model portfolios

With the number of investors seeking professional financial advice increasing, this year, FE made it its mission to help Advisers further streamline their investment process by offering them a robust and repeatable investment process that will improve efficiency and add real value to investors. This lead to the creation of a new breed of risk targeted model portfolios called FE Invest.

FE Invest offers Advisers a suite of risk optimised model portfolios targeted at the complete range of investor risk profiles. With a range of portfolio types including Actives, Hybrids and Income, the range of term weighted portfolios is rigorously managed to ensure they meet strict targets on performance and volatility.

5. Launching the UK’s First Objective Passive Rating

Whilst the asset management industry continues to be plagued by the Active Vs Passive debate, FE takes great pride in providing Advisers & Asset Managers with objective ratings that assess the quality of both Actively and Passively managed funds.

The newly launched FE Passive Fund Rating is the most extensive rating system of index tracker funds in the retail industry, ranking exchange traded funds and passive funds alongside each other for first time. Unlike other more limited qualitative passive rating services, the FE Passive Fund Ratings are unique in that funds are ranked objectively and transparently using a quantitative methodology. This ensures that Advisers can give impartial and independent advice which until now has only been available on Actively managed funds. The rating currently scores around 250 ETFs and passives – giving Advisers a clearer idea of the passive funds they are investing in.

The industry revered FE Crown Ratings continue to rate actively managed funds using an impartial quantitative methodology. Please visit the links below to view the rated funds and to find out more on the methodology.

http://www.trustnet.com/learn/learnaboutinvesting/fe-passive-fund-ratings.htmlhttp://www.trustnet.com/learn/learnaboutinvesting/FE-Crown-Fund-Ratings.html

6. Active List Pro on FE Analytics

Model Portfolio, Multi-Asset Fund, Unit Trust or Investment Trust – no matter what the instrument of choice is – it is added to an ‘Active List’ on Analytics for research and analysis. The Active List Pro now allows for funds from different universes to be added onto the same Active List; giving Advisers the freedom to compare, contrast and review suitability of selections within a single universe/mandate agonistic frame.

The Active List Pro is particularly useful whilst balancing diversification and also in portfolio construction.

7. Ability To Forecast Investment Returns

A favourite amongst our clients is the FE Investment Forecaster that is available on FE Analytics. The forecaster helps Advisers understand the likely return of proposed portfolios over a number of different time horizons. Based on the asset allocation of each portfolio, the forecaster provides a range of likelihoods of achieving certain targets in the future.

The tool comes in particularly handy for Advisers who are providing pension accumulation advice. The chart below shows likelihood of two portfolios providing consistent income over 26 years with a £2,000 annual withdrawal.

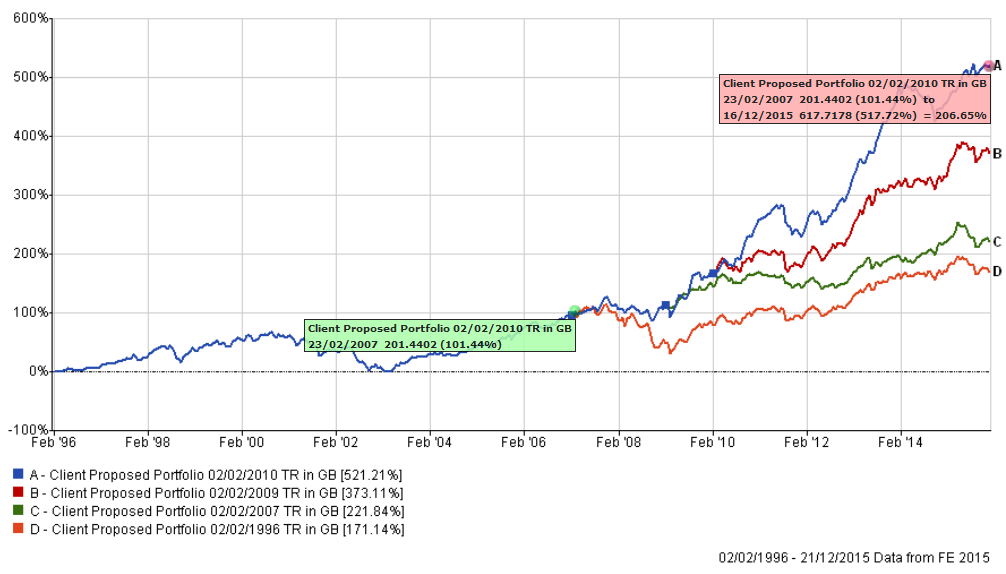

8. Dynamic Portfolio Modelling

The Dynamic Portfolio Tool (DPT) has helped Advisers to build, monitor and review self-built, Model and Discretionary portfolios. The historic nature of the tool tracks key switch points within the life of the portfolio – allowing Advisers to demonstrate the value of their recommendations.

FE Transmission users use the tool to track changes to their Discretionary or Model portfolios, giving them the power to judge the active management their investors are paying for.

9. Bespoke Report Building

9. Bespoke Report Building

The FCA is increasing its focus on improving and encouraging effective communications within the financial services industry. Firms are being urged to produce client communications that are comprehensive and engaging yet easy to understand, with a view to helping the end investor be well informed.

The Custom Portfolio Report Builder (CBRP) tool on FE Analytics allows Advisers to create fully customised reports, built specifically to suit the individual needs and objectives of clients. The tool gives the Adviser the freedom to either create comprehensive reports including portfolio scans or to keep it simple in a standardised template format.

10. Variety Of Presentation Tools

Good client engagement is central to the success of any Advisory firm, but often fail to engage due to excessive jargon used by analysts or paraplanners to explain complex financial terminology and situations.

One enthusiastic Adviser we met at the PFS conference this year, told us how he used the wide variety of charts on FE Analytics to get around this problem – especially when it came to generating new business and meeting new prospects. The example he used was of the ‘Inflation adjusted chart’ which helped him demonstrate the true value of investing alongside the value of his recommendation over the client’s existing portfolio.

11. FE Analytics Partnerships

FE takes pride in working with other leading Adviser solution providers including back office systems and platforms to offer clients added value. The latest in such partnerships are the integrations with Intelliflo and Time4Advice.

Advisers can now import client portfolios from Intelliflo’s Intelligent Office and Time4Advice’s CURO into FE Analytics for research and analysis. Reports and chart outputs can be exported back into Intelligent Office to be saved under client names. These integrations have helped hundreds of Advisers to optimise their investment selection process and save time by making re-keying a think of the past.

12. Staying Up-to-date

Number 12 – the last one on the list. You have now probably packed up and ready to leave for Christmas- but what about your investments? The Alerts Manager on FE Analytics is designed to help Advisers keep an eye on investments whilst away making eggnog, holidaying on a beach etc...

By setting up the alerts in the three easy steps – Advisers enjoy customised notifications tracking any significant changes to funds that effect the client’s portfolio including asset allocation, performance, manager details, market outlook, industry news and more.

Contact us on enquiries@financialexpress.net for more information.