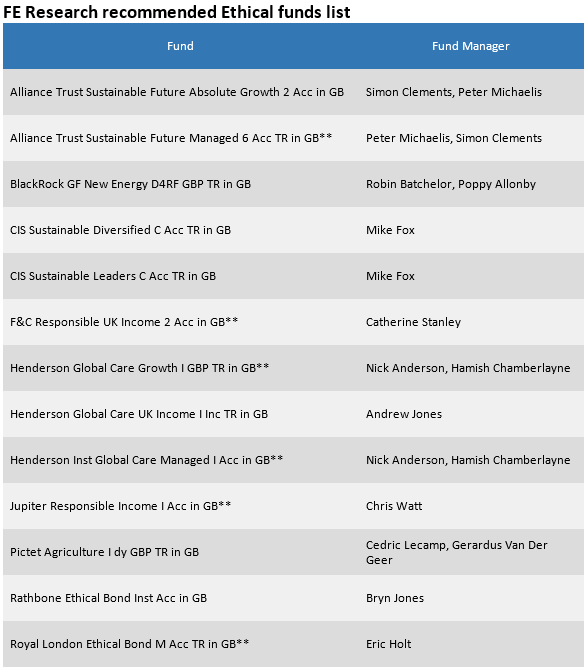

Just thirteen ethical funds from the ethical and socially responsible investment universe made the cut in the inaugural recommended ethical funds list from ratings, research and investment data specialists FE Trustnet. Henderson Global Investors bags three spots for its sustainable range.

The ethical investment sector has grown-up a fair bit over the past few years, its cause furthered by a change in consumer sentiment – largely fuelled by the financial crisis and a drive to attach responsibility to the way we look at and use our money.

This means that more people than ever want to use the power of their money to do good, but there still remains a significant gap in ratings and research firms offering proper guidance on the ethical investment sector.

With this gap in mind, the FE Research team assessed more than 200 funds which fall under the ethical/SRI banner in the current market, to draw up a list of high-performing funds which are true to their SRI and ethical objectives. The list approved ethical list of funds will now sit within the FE Invest Approved list.

Charles Younes, lead analyst overseeing the new launch from FE Research, says: “Despite the fact that the market for ethical investments has grown quite a fair bit in recent years, there is still a distinctive lack of guidance for consumers who want to park their money in a more socially responsible manner. For advisers of more ethically-minded clients the lack of true guidance backed up by research makes it that much more difficult to pinpoint just which fund does what it says on the label.

“This lack of true assessment prompted us to look at this sector. Through both quantitative and qualitative assessment, we drew up a list of funds where the manager consistently met the fund’s SRI and ethical objectives but importantly - also offered a high-performing fund.”

From 218 funds, the FE Research team whittled down to 25 funds by using the same stringent performance requirements that funds are put through in order to make it on to the FE Invest Approved list. After this, qualitative assessment was carried out to determine whether the manager met the fund’s specific objectives.

Three Henderson funds made the list – Global Care, Global Care UK Income and Global Care Managed, while Alliance saw two of its funds – Sustainable Future Absolute Growth and Sustainable Future Managed funds making the list.

Mika-John Southworth, director at FE Trustnet, says: “The rise in interest in ethical funds is not surprising. People care about where their money is being invested and indeed recent research suggests that 75% of people would be unhappy knowing that their money is invested in unethical funds. The FE Ethical Funds List allows investors to make sound investment decisions that are good for their finances, wider society and good for the planet.”

Source: FE Trustnet data. Correct as of 22/07/2015