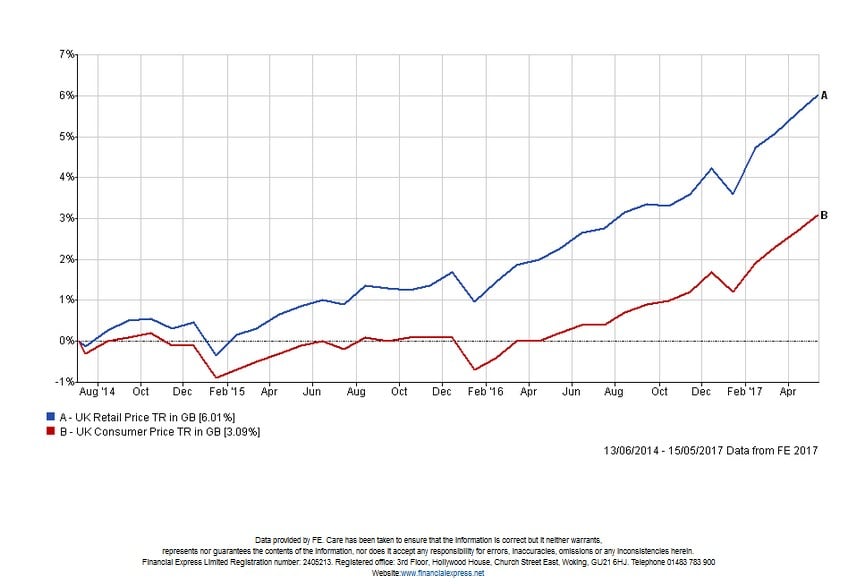

Inflation in the UK hit a record high of 2.9% in May 2017 and is set to soar to 4% in the second half of the year as per forecasts from the National Institute of Economic and Social Research. Data from FE Analytics shows the upward trend in the UK Consumer Price Index and UK Retail Price Index over the last five years to 3.09% and 6.01% respectively (as at 10th July 2017).

Concerns around rising inflation and poor interest rates have filled the personal finance pages of broadsheets and trades for weeks now with analysis from Minerva Lending saying that inflation is eroding UK savers’ cash to the tune of £377 a second. UK savers hold £700bn in deposits (FCA Cash Savings Market Study Update 2016), however thanks to inflation these accounts are allegedly losing £32.6m a day even at an above average interest rate of 1.2%.

Dash for cash

As inflation eats away the purchasing power of investor money, the industry has been warned of a "gap in consumer awareness" after a survey by YouGov for Zurich revealed more than a third of savers could not say how they would go about defending their money against rising inflation. Surveying more than 4,000 UK adults, the study warned millions of people would see their savings shrink if they did not know how to achieve enough growth to beat inflation as twice as many people thought a cash ISA would offer better protection against inflation compared to a stocks and shares ISA.

Need for qualified financial advice

Now more than ever, there is onus on the industry to inform, educate and help investors protect their hard-earned savings and Financial Advisers play a particularly crucial role in this. Effective client communication and engagement initiatives can highlight the real value investing can give to capital protection and go even further by achieving real returns for investors.

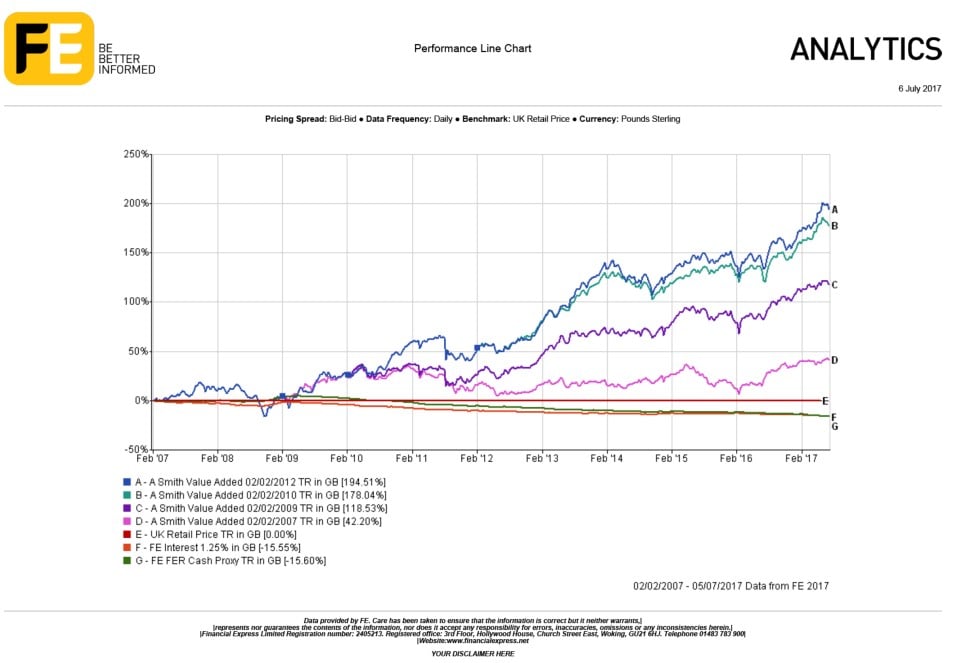

Many of FE’s Adviser clients rely on FE Analytics to create investor communications and commentaries, as the system provides access to a range of interactive graphs, charts and reporting templates. The image featured below is an indicative example of a very popular chart extracted from the system.

The chart provides returns of a portfolio relative to inflation represented here by the Retail Price Index (or CPI). The graph also includes a cash proxy and bank interest rates to provide an illustration of how the different elements compare to each other – offering a powerful indication of the benefits of active management whilst also demonstrating the value of your Advice service.

For information or a free trial of FE Analytics, please contact us at enquiries@financialexpress.net

More information on the Minerva research found here: https://www.ftadviser.com/investments/2017/06/22/inflation-erodes-377-from-client-accounts-every-second/

More information on the Zurich research can be found here: https://www.professionaladviser.com/professional-adviser/news/3008801/more-than-third-of-savers-at-a-loss-how-to-fight-inflation