First published in Professional Paraplanner Magazine, April 2016.

Advisers are not always expert stock pickers and shouldn’t have to be. Post RDR and in preparation for the looming sunset clause, more advisers are starting to recognise the benefit of allowing specialists to deal with their fund picking as a key strategy for spending more time with clients, reducing risk levels and operating costs. Results from the FE Adviser Survey 2016 were testament to this.

It found that 89.5% of the respondents intended to use a ‘readymade’ investment solution in the next 12 months. Of particular note was the significant interest in multi-asset solutions with 37% of the respondents planning to commit at least 10% of client funds into the unitised portfolios.

The analysts at FE Research say that increased inflows into multi-asset funds are hardly a surprise as they offer robust solutions in accumulation, decumulation and income seeking strategies, by providing advisers with a one-stop shop for cost-effective asset allocation, risk management and rebalancing. However, the onus of establishing and demonstrating suitability still very much lies in the hands of the adviser. Time and again, the FCA has made it clear that choice of an investment proposition should be dictated by due diligence in selection and, more importantly the suitability of the products/services for the individual client (CWC research, 2016).

Let’s take a look at a few key points for conducting objective due diligence on multi-asset solutions.

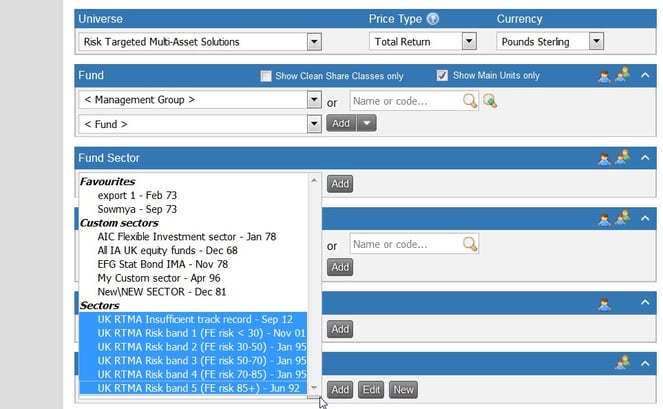

RISK: Communicating risk to clients is often the biggest challenge for most financial advisers. To help advisers and planners to better understand, analyse and compare the risks involved in multi-asset solutions, FE Analytics offers users a specialist Risk Targeted Multi-Asset Universe that gives close to 500 multi-asset funds a risk rating based on their designated FE Risk Score.

The RTMA universe holds 5 sectors based on the unitised portfolios’ volatility relative to the FTSE 100. The risk levels are actively monitored and funds are reassigned to different sectors if the risk scores move and remain outside of their assigned risk band for more than 16 weeks. The sector breakdowns offer a great starting point for research and contribute towards a verifiable a udit trail.

udit trail.

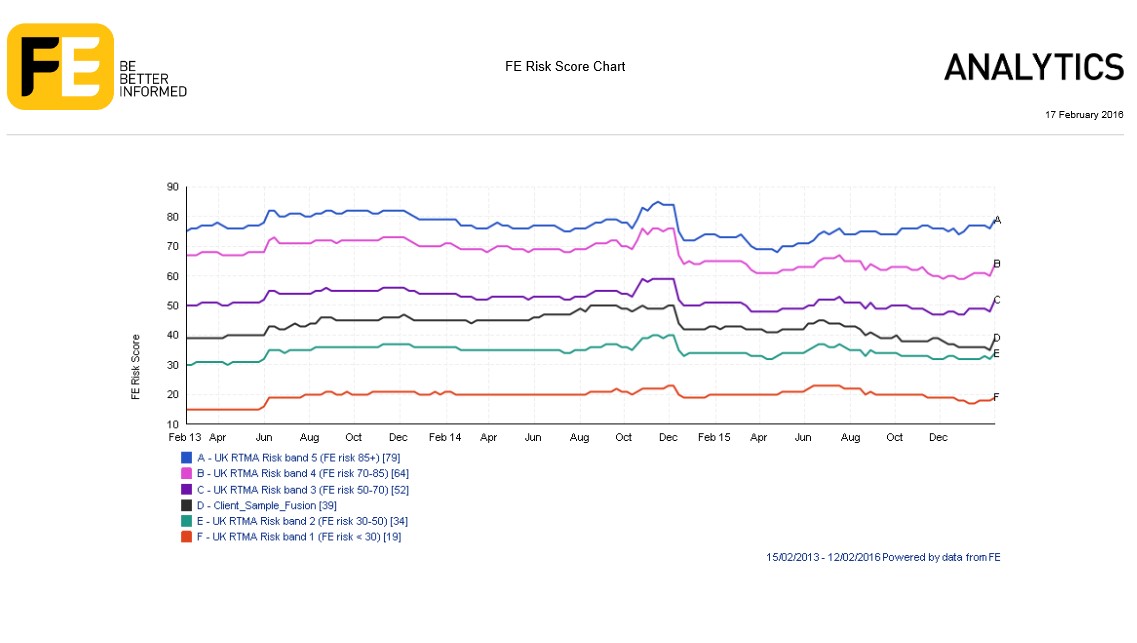

The Risk Targeted sectors also lends themselves to client education. The FE risk score chart below displays the cumulative returns of different risk levels offering an intuitive manner of explaining the relationship between risk and reward to clients.

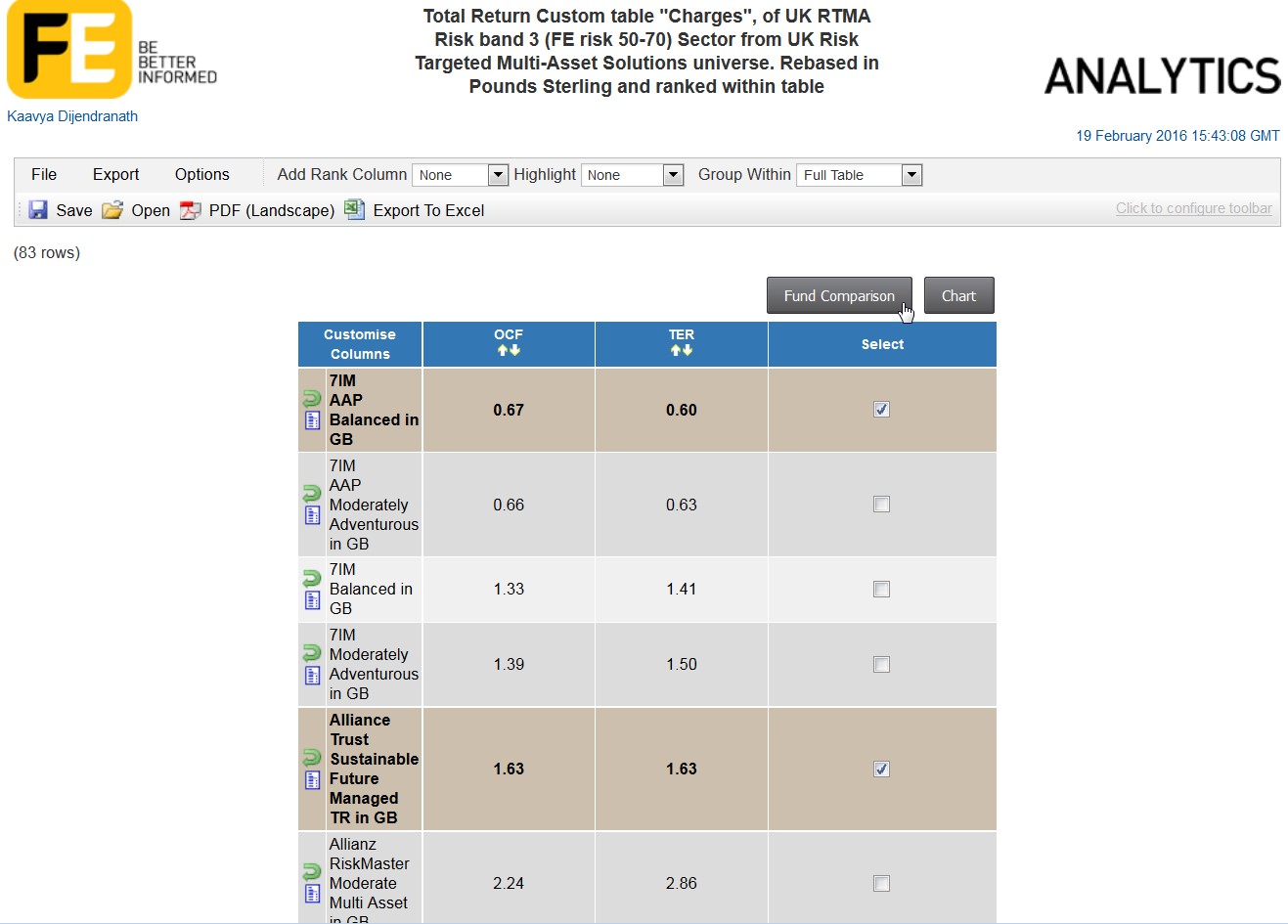

COST: Costs play a crucial part in suitability – nearly 30% of the respondents in the FE Adviser Survey said that costs of the MM/MA solution they would choose was the most important factor in selection. Unfortunately however, outsourced propositions have recently received bad press on the transparency around the costs incurred for the end investor. The narrative highlights that the lack of information and the ability to compare charges puts advisers at the risk of allegations of negligent advice. (Professional Adviser, 2016).

The legacy of data collection that powers FE Analytics enables advisers to verify OCF / TER data and to conduct comparisons. Below is bespoke report created on FE Analytics that lists the OCF & TER data for all the Multi-Asset funds in the RTMA Risk band 3.

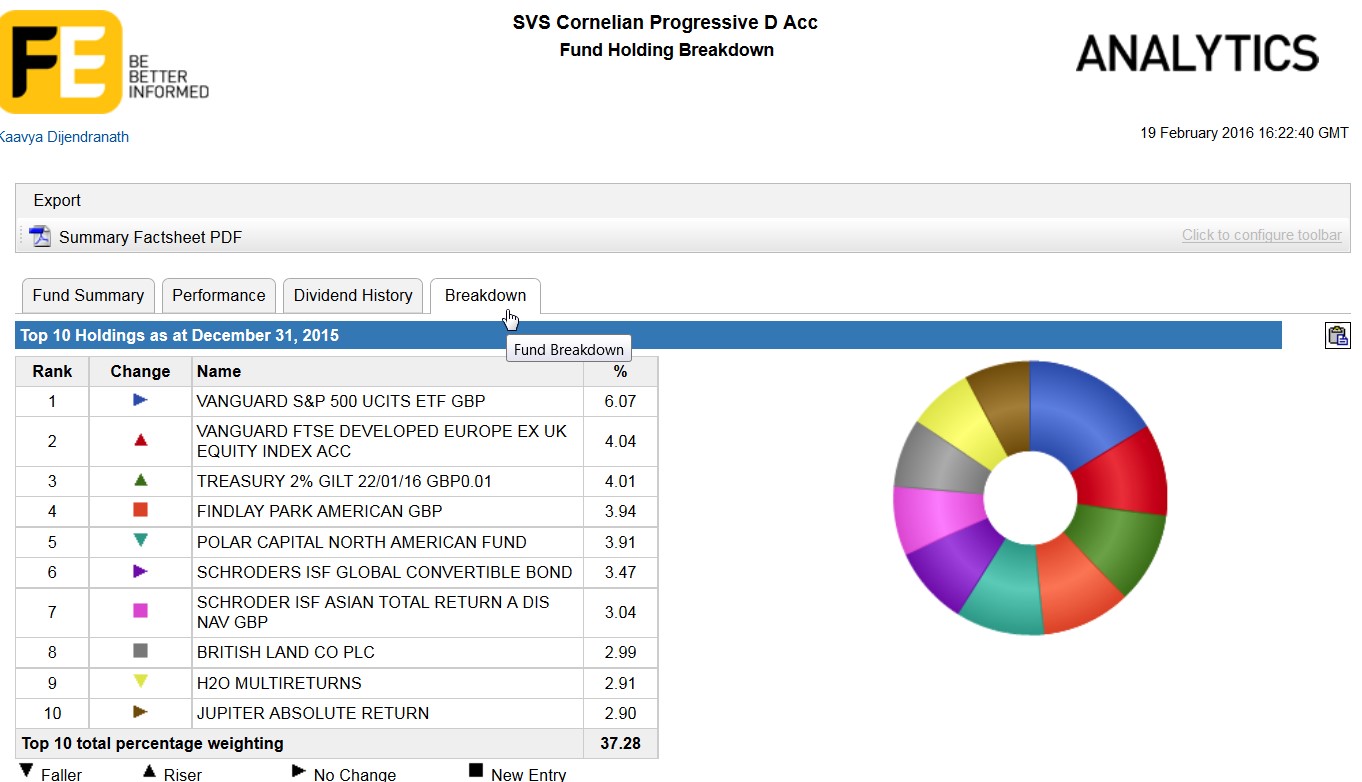

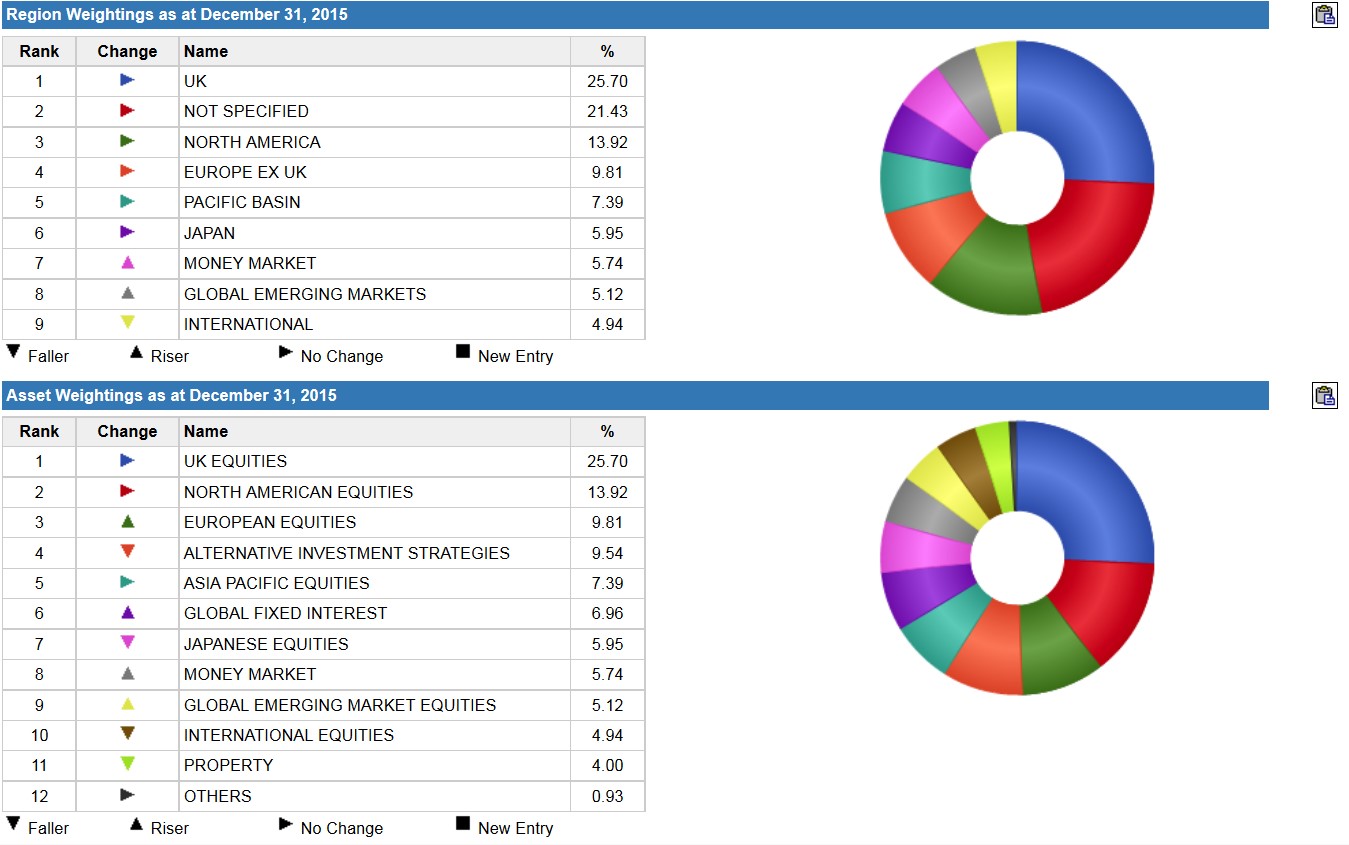

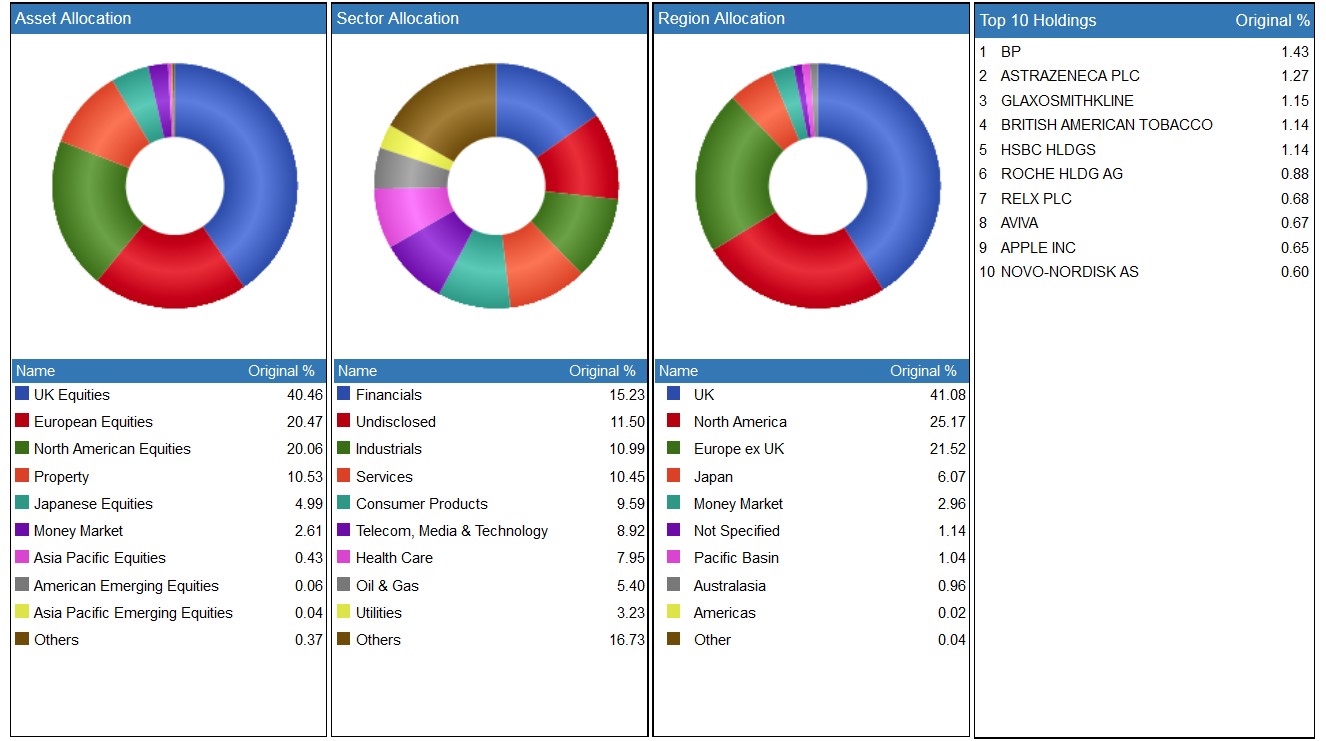

GRANUALAR RESEARCH: A multi-asset fund is in essence a delicately constructed portfolio that strives to achieve a particular objective. When used alongside or ‘blended’ with other multi–asset funds within a single client portfolio it can lead to massive skews within the client’s overall asset allocations. Advisers should be cautious of this unplanned overexposure by conducting granular research on the funds – a view supported by recent research from The Lang Cat says that it is impossible for advisers to determine suitability of multi-asset and DFM options by looking just at aggregate data and they must ‘drill down’ into the detail.

Multi-asset fund factsheets on FE Analytics offer a comprehensive view of building blocks of the portfolio. Below is a sample factsheet that gives holdings data, geographical exposure, asset allocation and more.

B

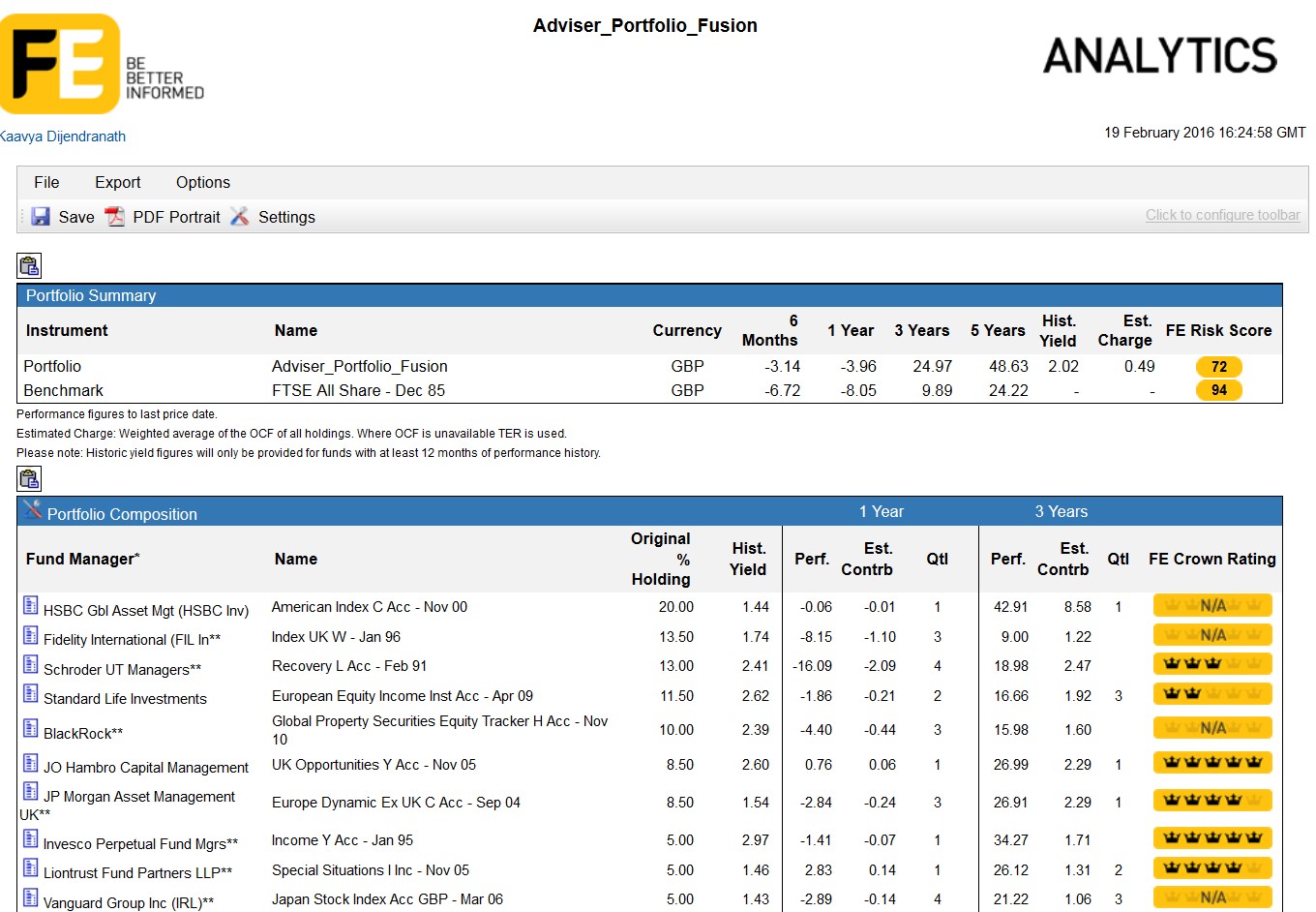

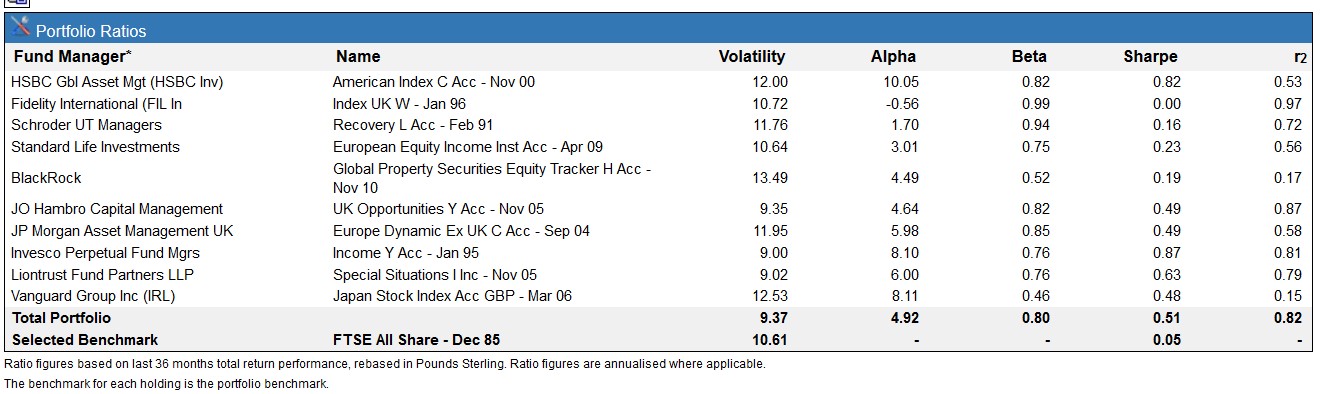

The dynamic portfolio tool on FE Analytics –helps you to assess the total weighting of your clients’ portfolio. So, if you are an avid believer in blending – you can use the tool to rebalance and monitor client portfolios.

REPORTING: With all that research – you have got to have something to show your client!

The Custom Portfolio Report builder on FE Analytics gives Advisers the ability to create bespoke, white- labelled reports that allows clients to understand what makes up their multi-asset portfolio and how appropriate due diligence has been undertaken on making sure it’s an investment solution that best matches their needs.

For a free demonstration and trial of FE Analytics please contact enquiries@financialexpress.net or call 0207 534 7667